Stock Market Discussion

^ Would be nice.

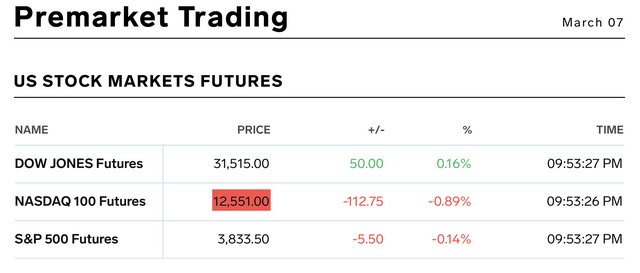

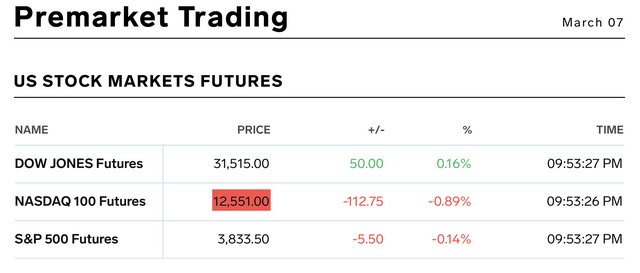

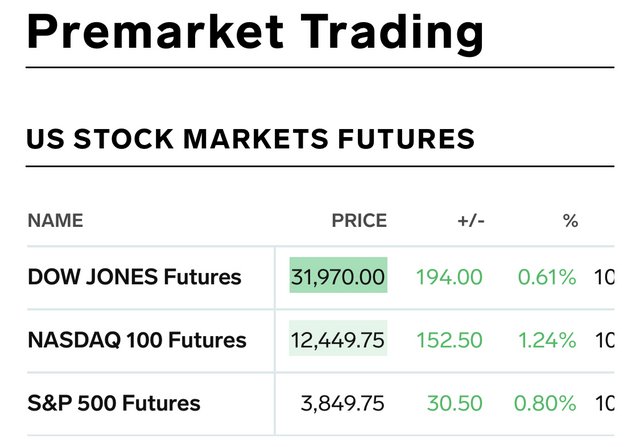

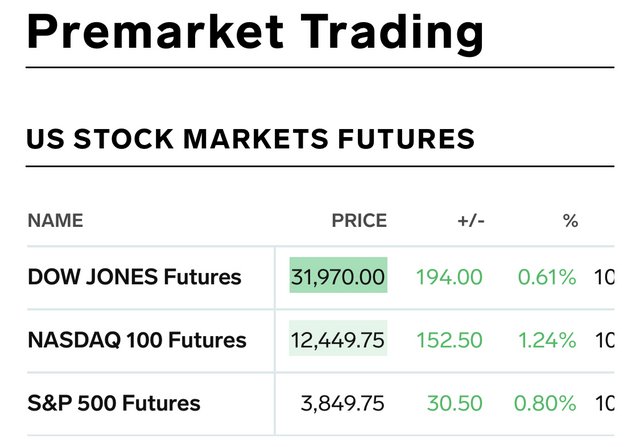

It appears NDX might be red as drymount tomorrow. I knew I wasn’t comfortable with those AMD calls, lol (they are two weeks out, but still). Things, of course, may change by the morning.

It’s drymounting Tesla’s fault.

It appears NDX might be red as drymount tomorrow. I knew I wasn’t comfortable with those AMD calls, lol (they are two weeks out, but still). Things, of course, may change by the morning.

It’s drymounting Tesla’s fault.

Hopefully, these numbers will translate into a nice nasdaq green tomorrow. My AMD calls need a solid pick-me-up, lol.

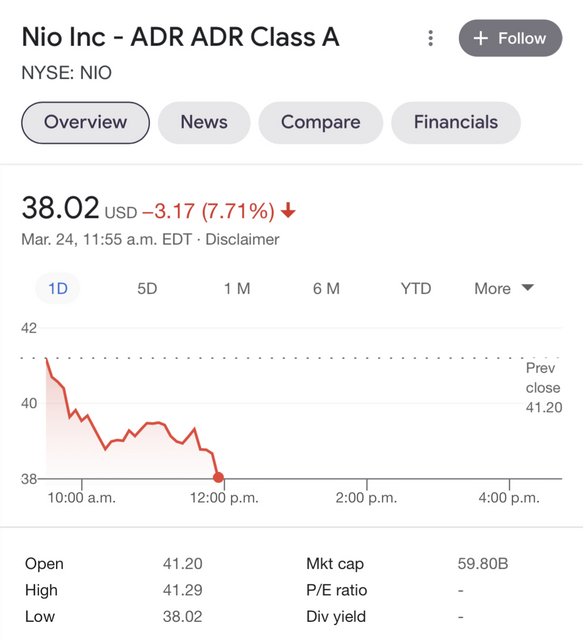

I also bought some NIO calls not exactly at the bottom because apparently there isn’t one.

Still pissed about the VFF stop.

I also bought some NIO calls not exactly at the bottom because apparently there isn’t one.

Still pissed about the VFF stop.

Crazy run!

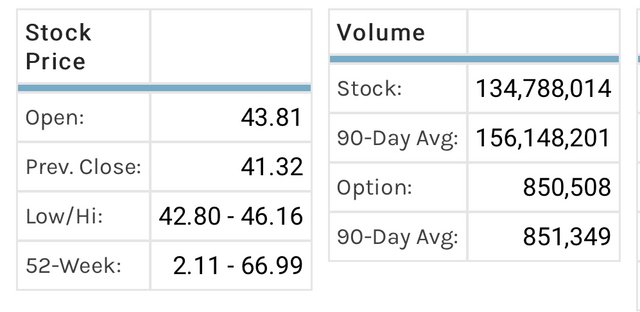

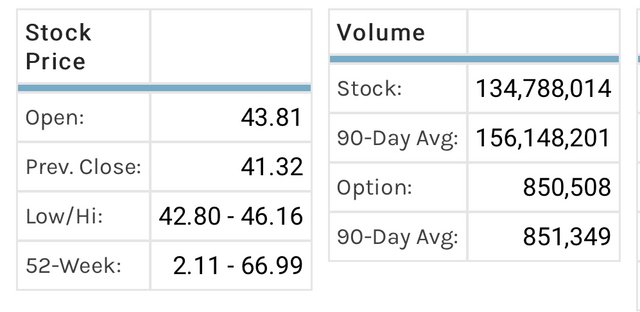

Those NIO calls really paid off, though I sold low. Bought 42 and 42.5 puts at what appears to be the top at the moment. This run is unsustainable, imo. That gap at the open is uncomfortable too. I think it is downhill from here, but we will see.

Sold the TRLY calls from last week. Should have sold VFF calls too...

Also sold RCL calls.

Bought WKHS puts and down substantially on those for the time being. I think it’s the right call, but...

I wasn’t comfortable with the 80-strike AMD calls I already mentioned somewhere above and tried to sell at a tiny profit and then at breakeven, but it didn’t take. So I bought some puts with the strike of $79 to offset my feelings, lol.

Edit the next day: Guess I was wrong, lol.

Edit maybe 30 minutes later: Maybe I wasn’t. Crazy movement.

Those NIO calls really paid off, though I sold low. Bought 42 and 42.5 puts at what appears to be the top at the moment. This run is unsustainable, imo. That gap at the open is uncomfortable too. I think it is downhill from here, but we will see.

Sold the TRLY calls from last week. Should have sold VFF calls too...

Also sold RCL calls.

Bought WKHS puts and down substantially on those for the time being. I think it’s the right call, but...

I wasn’t comfortable with the 80-strike AMD calls I already mentioned somewhere above and tried to sell at a tiny profit and then at breakeven, but it didn’t take. So I bought some puts with the strike of $79 to offset my feelings, lol.

Edit the next day: Guess I was wrong, lol.

Edit maybe 30 minutes later: Maybe I wasn’t. Crazy movement.

^ Nice.

Dumped all the puts yesterday during a breather and managed to make ok money on them. Except for NIO $42.5-strike, which I held and they are turning into an oblivion pretty quickly here, lol. Nio to the moon? Still don’t see how it can run like that: is it up 40-50% in the past 4-5 days?

Dumped all the puts yesterday during a breather and managed to make ok money on them. Except for NIO $42.5-strike, which I held and they are turning into an oblivion pretty quickly here, lol. Nio to the moon? Still don’t see how it can run like that: is it up 40-50% in the past 4-5 days?

Yeah, without a doubt. The fact that it is doing all that without the extra volume is kind of suspicious to me. It’s a heck of a run and it doesn’t look sustainable to me. We will see.

Edit: There were also 3 (!) gaps in a row now and only one has been filled yesterday. Perhaps, a 4th tomorrow. Who knows. I think it will come down hard once again. Depending on how things progress, I will probably be buying some puts a few weeks out.

Also, CAN had an insane few days. That one will crash without a doubt. Option are expensive as drymount though and IV is crazy high.

Edit: There were also 3 (!) gaps in a row now and only one has been filled yesterday. Perhaps, a 4th tomorrow. Who knows. I think it will come down hard once again. Depending on how things progress, I will probably be buying some puts a few weeks out.

Also, CAN had an insane few days. That one will crash without a doubt. Option are expensive as drymount though and IV is crazy high.

Haven’t done much, only a few trades in the past week. No time.

NIO is stumbling and not looking good, IMO. Still no volume.

On Wednesday, I sold my 42.5 puts I mentioned earlier for a “bit” of a loss. But I bought 45 puts the day before, which I sold on Thursday and recovered some of what was lost. I should have kept those 42.5’s till Thursday too, but “chickened out”. I would be in the net green on these two trades, but it is what it is.

Note that all the gaps are now closed except for that first one (on the 9th).

Also, I see this pattern taking a form:

If that’s where it is heading (rather shouldering, lol), that one gap will be closed. In fact, I am not sure how far it would fall (low 30’s or 20’s?). It will be interesting to see where it goes next week. I would be making sure to set the stops if I was holding NIO.

And, again, that volume is concerning. Not only is it low, it is also decreasing.

It seems to me that down is the way it is going to go.

Tesla’s chart also sucks. Buying volume comes in to keep it above support, barely, not to grow.

Buffet’s BYD looks similar to NIO:

I bought some RCL and CCL calls on Tuesday (?). Fingers crossed they don’t issue more shares before I sell those, lol. Too much risk with these, for my comfort.

I also bought BITF shares at some point this week. Debating whether I should sell them before earnings next Thursday.

NIO is stumbling and not looking good, IMO. Still no volume.

On Wednesday, I sold my 42.5 puts I mentioned earlier for a “bit” of a loss. But I bought 45 puts the day before, which I sold on Thursday and recovered some of what was lost. I should have kept those 42.5’s till Thursday too, but “chickened out”. I would be in the net green on these two trades, but it is what it is.

Note that all the gaps are now closed except for that first one (on the 9th).

Also, I see this pattern taking a form:

If that’s where it is heading (rather shouldering, lol), that one gap will be closed. In fact, I am not sure how far it would fall (low 30’s or 20’s?). It will be interesting to see where it goes next week. I would be making sure to set the stops if I was holding NIO.

And, again, that volume is concerning. Not only is it low, it is also decreasing.

It seems to me that down is the way it is going to go.

Tesla’s chart also sucks. Buying volume comes in to keep it above support, barely, not to grow.

Buffet’s BYD looks similar to NIO:

I bought some RCL and CCL calls on Tuesday (?). Fingers crossed they don’t issue more shares before I sell those, lol. Too much risk with these, for my comfort.

I also bought BITF shares at some point this week. Debating whether I should sell them before earnings next Thursday.

Cktbreaker, where are you at? Need some thoughts on NIO. I personally am thinking there is a solid short opportunity here with substantial returns, possibly. I couldn’t make myself pull it today (more like didn’t have much time to take a closer look before the end of the day).

^ Not in a good spot with that NIO, unless he is already out. I don’t see it, but maybe it will bounce back. Nothing is certain, obviously.

I have done some pretty good trades myself here. For example:

At least I sold some of those calls for profit, lol.

Too much other fudge to do this time of year, so I will be sitting out for a bit here (probably).

Edit: short everything, imo, lol.

I have done some pretty good trades myself here. For example:

Happening now:

At least I sold some of those calls for profit, lol.

For whatever reason thought the earnings day is today, so sold yesterday. The earnings day is tomorrow, apparently. Would have a couple more thousand of gains if sold today (planned to sell the day before earnings).

Too much other fudge to do this time of year, so I will be sitting out for a bit here (probably).

Edit: short everything, imo, lol.