Stock Market Discussion

-

cktbreaker

- Art Expert

- Posts: 1618

- Joined: Sat Jun 13, 2009 10:44 pm

Hey back from a week of sailing in the San Juan Islands, 20kt winds all week and saw a pod of Orca's, pretty cool to see. Ah lets see what you wrote here Bubbie.... about the MA thing, your assuming that I think MA is a stop loss spot. That is wrong, its the distance to a proper stop loss, if you enter a position at the moving average, its just an average and means nothing else and often a SL is no where in the area. And again my SL's are no more that 1-2% loss of my available cash. Things are more complex than you were assuming so I just kinda skipped the explanation. (I actually did talk a bit about it on that TLRY post) On the fib thing, I am not using it as a normal fib, its an algo based on some math and it is drawn at specific places not just top to bottom or vice versa. I am using it to confirm my prediction of price action. Same with the assumption on my going to wallstreet bets to talk, it was a couple friends I was talking about who trade like WSB, not the group as a whole. On the Tilray, I got one PT and got stopped but the entry was proper and that is what matters to me. Haven't looked at BABA, but if it was another break out trade like that BYN.UN or whatever it was then I would advise against breakout trading because the stop loss distance is too great and to do so is buying high not low the risk is great that it will not leave the range so just doesn't make sense. In fact I would be much more likely to short at a so called break out. Ok just peaked at BABA easy no trade to enter either way there from me, close to something but not there yet and don't like where the stoploss would be. If you were trading by price action you would be long at 222.36 range, where you're talking about longing 238ish is after the move and so where do you put a SL? There is no proper place to put it because support is back down at 222ish, another way to say that is that would be buying high not low. By the way fibs, patterns, volume, any indicators are not price action trading. Bubbie if you want to talk charts or entries post some up prior to your entry, post where you would put your entry and stop loss and why, then we can talk about it, much more interesting that way.

-

cktbreaker

- Art Expert

- Posts: 1618

- Joined: Sat Jun 13, 2009 10:44 pm

Here's how I traded the TLRY over a week ago now.

Bubbie don't know why you called this breakout trading. But share your thoughts as to why you thought it was breakout trading and we can discuss.

Bubbie don't know why you called this breakout trading. But share your thoughts as to why you thought it was breakout trading and we can discuss.

-

cktbreaker

- Art Expert

- Posts: 1618

- Joined: Sat Jun 13, 2009 10:44 pm

Here is an inverted chart of the same trade, now if I was longing here it would be breakout trading because it is at resistance. But in reality TLRY was at support, support was broken and I was stopped. You follow that Bubbie?

Glad you had a good vacation.cktbreaker wrote: ↑Mon Apr 19, 2021 3:00 pmHey back from a week of sailing in the San Juan Islands, 20kt winds all week and saw a pod of Orca's, pretty cool to see.

I am actually not assuming anything. It seems that you are the one making assumptions. So I will reiterate (for at least 3rd time, probably more), nowhere did I say that you put your stops (or enter a trade) at a MA. I don’t think I want to discuss it any more than I already did in my previous posts.cktbreaker wrote: ↑Mon Apr 19, 2021 3:00 pmAh lets see what you wrote here Bubbie.... about the MA thing, your assuming that I think MA is a stop loss spot. That is wrong, its the distance to a proper stop loss, if you enter a position at the moving average, its just an average and means nothing else and often a SL is no where in the area.

I never argued that.cktbreaker wrote: ↑Mon Apr 19, 2021 3:00 pmAnd again my SL's are no more that 1-2% loss of my available cash.

Cool. Did you write the algorithm yourself or is it someone else’s. If not yours, mind sharing which one it is? I would be curious to take a look.cktbreaker wrote: ↑Mon Apr 19, 2021 3:00 pmThings are more complex than you were assuming so I just kinda skipped the explanation. (I actually did talk a bit about it on that TLRY post) On the fib thing, I am not using it as a normal fib, its an algo based on some math and it is drawn at specific places not just top to bottom or vice versa. I am using it to confirm my prediction of price action.

I never said you go to talk to WSB. I never said I do either (I said I tried once, but turns out I can’t even post there because I am not really a reddit dude and don’t have enough posts and “karma”, so the few posts I made there were auto-deleted).cktbreaker wrote: ↑Mon Apr 19, 2021 3:00 pmSame with the assumption on my going to wallstreet bets to talk, it was a couple friends I was talking about who trade like WSB, not the group as a whole.

Great layout on the thought process with the visuals. And yes, I do follow. There is really no need for these snarky remarks. I have already told you I know why you bought there and why it didn’t really work out.cktbreaker wrote: ↑Mon Apr 19, 2021 3:00 pmOn the Tilray, I got one PT and got stopped but the entry was proper and that is what matters to me.

My thought process would be slightly different. If I chose to enter the trade as you did, my initial SL would be similar to yours (I would drop it a few cents). However, I would likely only get in past $21, so things would be different. I bought the calls, I believe I mentioned in this thread, at pretty much what you are now referencing for your SL (I think that’s exactly what it was, but I am not 100% on that; need to check). I don’t see myself buying into $20’s here, don’t see it as a good idea; hence, what I said. But we all do things differently and that’s fine.

Then again, I would never enter the trade to begin with because what happened the following Monday was kind of obvious to me (I didn’t think the impact would be that great on practically the whole sector though). There was nothing to pick and the probability (in my world) of loosing that 1%, or whatever it was you mentioned your risk was, was quite high simply contingent on that one piece of information (APHA’s earning the following Monday).

Lol. I never said you should wake up in the morning and buy in. I said there is a break out that could be quite profitable, potentially. Then I edited my post in the morning to say that the idea had failed.cktbreaker wrote: ↑Mon Apr 19, 2021 3:00 pmOk just peaked at BABA easy no trade to enter either way there from me, close to something but not there yet and don't like where the stoploss would be. If you were trading by price action you would be long at 222.36 range, where you're talking about longing 238ish is after the move and so where do you put a SL? There is no proper place to put it because support is back down at 222ish, another way to say that is that would be buying high not low. By the way fibs, patterns, volume, any indicators are not price action trading.

If it did work out as I thought it might, my initial SL would probably sit around $241.5, then moved to $252-ish. I would then be likely cashing in somewhere in $260’s, depending on how it would play out (the SL would be moved to the low $260’s and go from there). In a nutshell, that was the ~plan. I never really looked into it in great detail.

Sure, we can do that. I doubt I would be explaining why. We aren’t in school and I have already typed more than I should have here, really.cktbreaker wrote: ↑Mon Apr 19, 2021 3:00 pmBubbie if you want to talk charts or entries post some up prior to your entry, post where you would put your entry and stop loss and why, then we can talk about it, much more interesting that way.

It also seems to me that one of us is on the high horse and I am not really interested in the dick measuring competition. I could also pass on this thread altogether and do just fine.

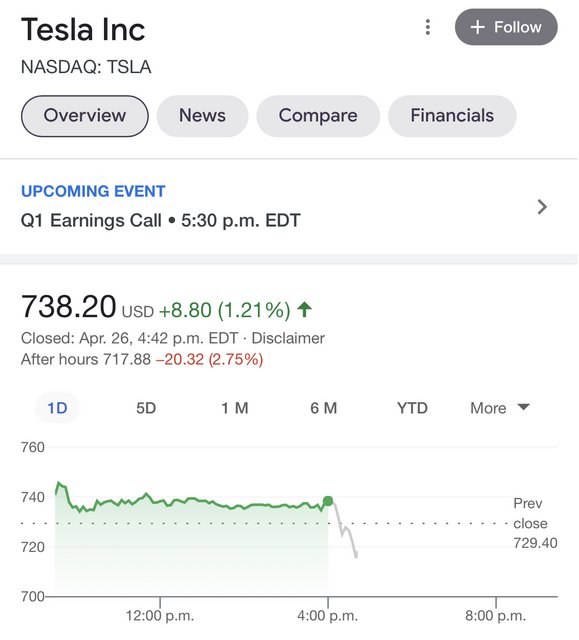

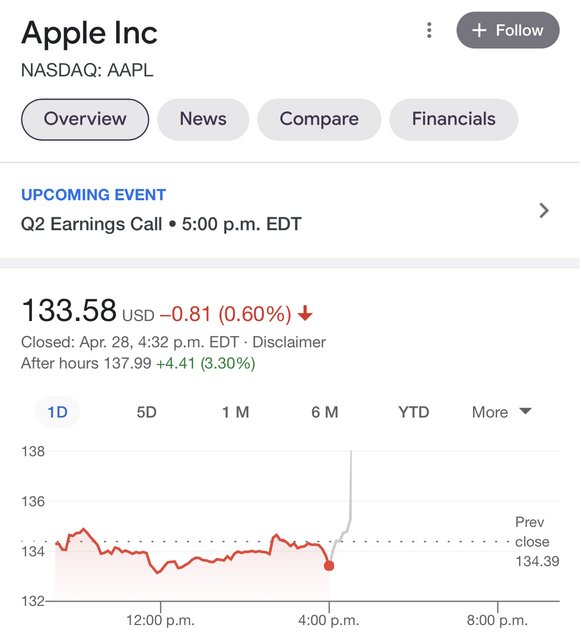

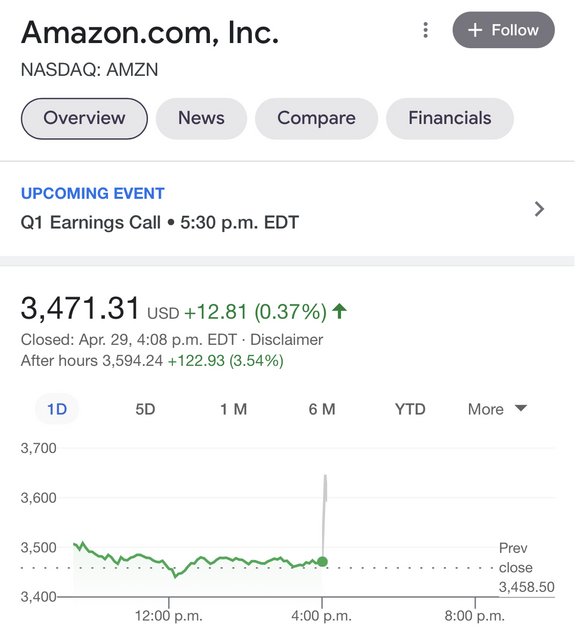

^ It’s up over 15% in the last week and a half or so. The surprise could go either way. I am leaning towards a drop regardless of what is reported. There are also a lot of the big boys reporting before Thursday, which may set the tone for the week. Tesla is tomorrow.

The coming week is like steroids of earnings. Will be interesting. Also, my arguably busiest week of the year at work.

Feeling like puts on QQQ and SPY would be good plays for the week, but a good way to loose money too.

The coming week is like steroids of earnings. Will be interesting. Also, my arguably busiest week of the year at work.

Feeling like puts on QQQ and SPY would be good plays for the week, but a good way to loose money too.

Nice piece on NIO:

https://realmoney.thestreet.com/investi ... Key+to+Nio

https://realmoney.thestreet.com/investi ... Key+to+Nio

The chart looks much better than it used to, without a doubt. This recent run also looks way more sustainable, you can clearly the difference:mr_rugby wrote: ↑Mon Apr 26, 2021 1:40 pmNice piece on NIO:

https://realmoney.thestreet.com/investi ... Key+to+Nio

It’s not just the slope of it, but notice how nice and smooth, uninterrupted or gapless, it is. I guess you can’t really see that “smoothness” on the previous pic:

You could see back then that the first run was bound to be drymounted. This current run looks a lot better (still a little steep, imo). I also do not particularly care for the OBV indicator they are referring to as a clear buy signal.

I wonder if it will run to that $45-46 range resistance before the call and fall after. I’d be probably cashing out if it hits that (depending). It is now up almost 20% in 8 trading days. I personally do not see earnings to be that favourable. Who knows.

What’s your average cost now, rugby?

To satisfy ck, my stop loss would currently be sitting at $41.6 or there about.

On a side note, MVIS appears to be creating some heavy bags there; probably by the end of the week there will be quite a few.

$40ish. I’m happy with where I’m at. I might grab some more if it opens red. I just have a feeling their earnings are going to surprise some people.

I also think NIO is setting themselves up for different revenue streams as well:

https://wccftech.com/nio-nyse-nio-to-ta ... structure/

https://cnevpost.com/2021/04/27/breakin ... ugh-pilot/

Thoughts?

Edit: https://cnevpost.com/2021/04/27/nios-fi ... 000-units/

Personally, I don’t see the battery swap as a viable business. In order for this model to be successful, there needs to be a uniformity in the battery market, which there isn’t. They would have to convince other manufacturers to switch to their batteries, which obviously isn’t going to happen unless a manufacturer has an inferior technology and if that is the case, Nio would be giving away their competitive advantage. No one is going to give up their superior technology either for the same reason.mr_rugby wrote: ↑Tue Apr 27, 2021 5:29 pm$40ish. I’m happy with where I’m at. I might grab some more if it opens red. I just have a feeling their earnings are going to surprise some people.

I also think NIO is setting themselves up for different revenue streams as well:

https://wccftech.com/nio-nyse-nio-to-ta ... structure/

https://cnevpost.com/2021/04/27/breakin ... ugh-pilot/

Thoughts?

Edit: https://cnevpost.com/2021/04/27/nios-fi ... 000-units/

Frankly, I do not see many private consumers using the service either. However, I never looked at the numbers and math, but I cannot imagine it being cheaper than plugging in in the evening. How would it work without a subscription? I would assume that an absolute majority would only use this service on rare long trips, which again doesn’t make sense because neither the consumer nor the company would be willing to give up a better/newer battery in exchange for an inferior/older one. I could be way off because I haven’t done much (or any) research on the subject, but I don’t see it.

Earnings didn’t look to be amazing and probably another drop tomorrow. Edit the next day: go figure, it’s up.

Honestly, I’d be looking for the first out and either move on to something else or simply swing trade it if that is your thing. I don’t think this one is going to moon and I would not (and I don’t) have it in my long portfolio either.

On another wave, all the big boys have reported.

No strikes. Seems like nothing else is left to carry the market in May though.

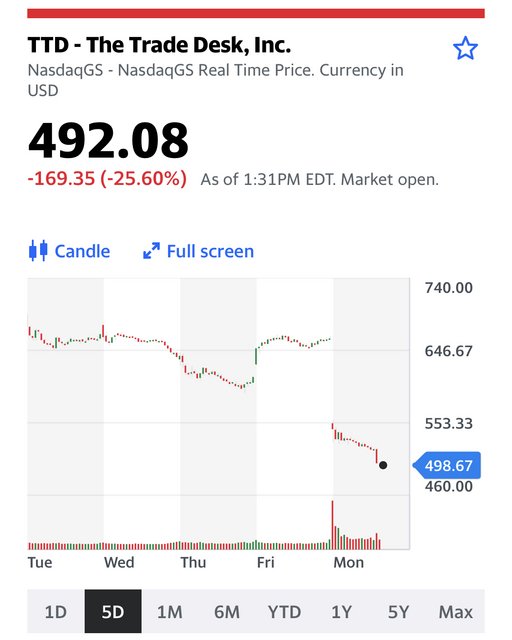

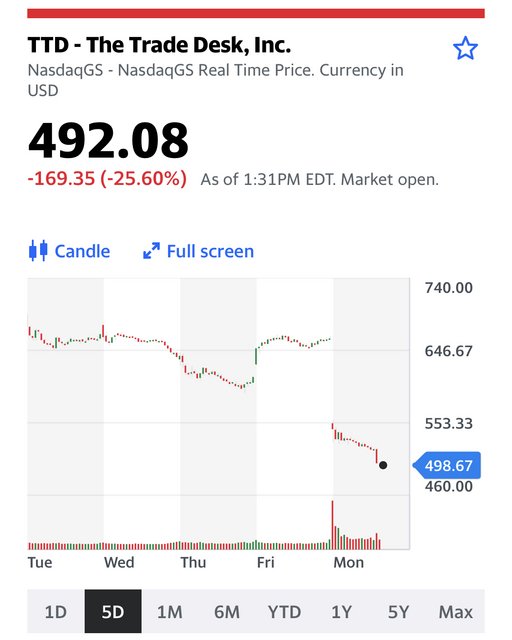

What the drymount happened to TTD today? Stock split, earnings aren’t bad. Down 25% and rolling. Tough luck for those who bought calls playing earning (or sold puts).

Evening edit: Futures are red as drymount.

Glad I cashed out (almost entirely) on Friday. I do still have a few calls that will be affected though, depending on what this turns into. And I sold the puts too early, it appears.

Evening edit: Futures are red as drymount.

Glad I cashed out (almost entirely) on Friday. I do still have a few calls that will be affected though, depending on what this turns into. And I sold the puts too early, it appears.

Happened to randomly stumble into the GME run up today. Had good times (and solid gains) buying $190-strike puts and selling them right away (well, within 10-11 minutes). Each batch sold at 20-25% profit, except for the last one. The last one was bought at $490 and sold at $520 per, 3 seconds before close, lol.