cktbreaker wrote: ↑Fri Mar 26, 2021 11:19 am

I went long some oil companies yesterday, hate it but I think that's where the money will be. MRO, VLO (which looks like a good long right now). Would like some MP but think i might have missed the entry on that one.

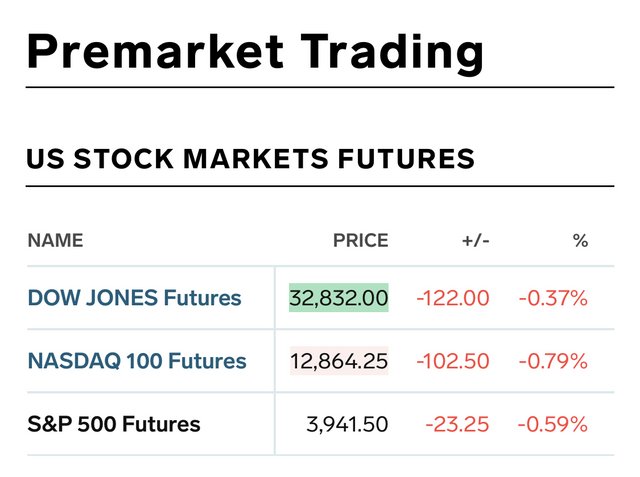

Vix is crazy high, indeed.

I am not entirely sold on oil, yet.

Not sure about VLO, but I looked at MRO a few days ago and thought it was back or close to pre-pandemic pricing, unless I am confusing it with something else. Not sure if there is much of a play there (to be fair, I have no idea what they did during the year after the crash).

Funny because I was looking at MP for a while now. Pretty sure it provided you with another opportunity to enter later in the day (there was quite a dump in the afternoon). Still not sure about it myself.

I am currently looking at REITs rather than oil. Purchased some BPY today, though I am not sure if it was a good move.

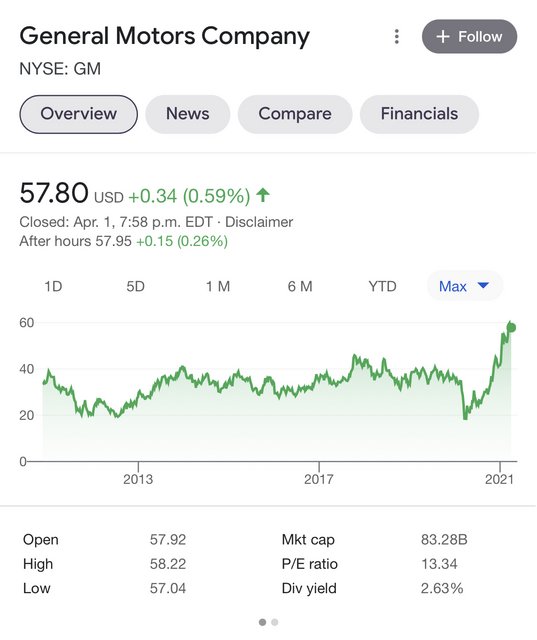

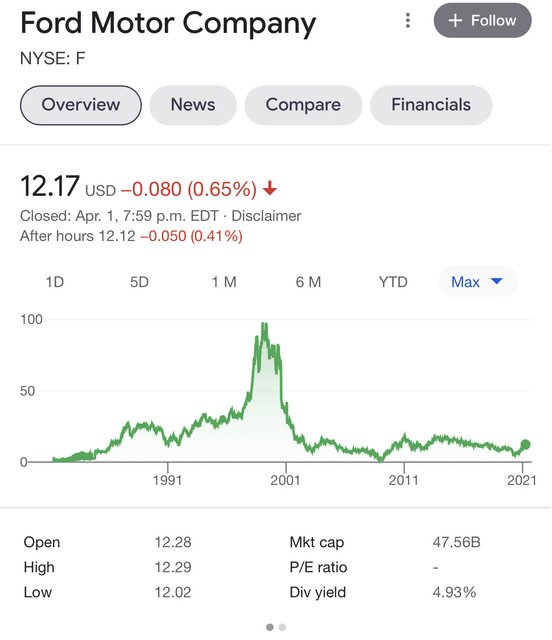

It seems that market overall is moving towards the boomer stocks.

cktbreaker wrote: ↑Fri Mar 26, 2021 11:19 am

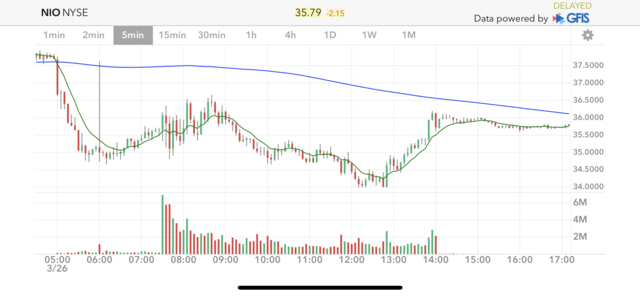

Here my daily NIO chart.

I think 29 ish is probable, often price will go to the 4.618. Might do a trade at 29ish, but would be quik to take profits at the red wick and the bottom of the swing there then move the stop up into profit. You can see price rejected at 45.63 so nothing has been gained, until something is gained NIO should continue down. Same scenario from a few weeks back where it didn't gain 52.08 like we were talking about. I should add that if NIO can close a couple daily candles above 45.63 a long at 39.26 would make sense.

I think NIO is going to tank for the time being. The news yesterday that they shut down their production for 5 days due to the chip shortage could not have come at a worse time either. Probably will end up being more than 5 days too. And probably more shut downs in the future because this chip issue isn’t going to be resolved that quickly.

That just goes on top of the fact that the charts look like fudge, really. The pattern I mentioned on the previous page is pretty much complete now and it is highly unlikely, in my opinion, that it will go up from here. Maybe a bounce, but downhill later. Volume has increased in the past couple of days, but it is still low in comparison.

Probably easier to see the pattern on the line chart (if anyone is interested):

About the only “good” thing here for NIO is that the 200-day moving average should serve as a strong support. On the other hand, that 50-day MA (I think that’s what I have set up, I should check) is about to cross it and that’s where things will begin to fall apart further, perhaps. Daily chart:

To me, there are at least two interesting things here about the volume. One I already mentioned: it is decreasing. The recent rise in volume suggests that selling is winning, so far. The second is that since about late December or early January, two consecutive green bars are followed by a sell off, without exception.

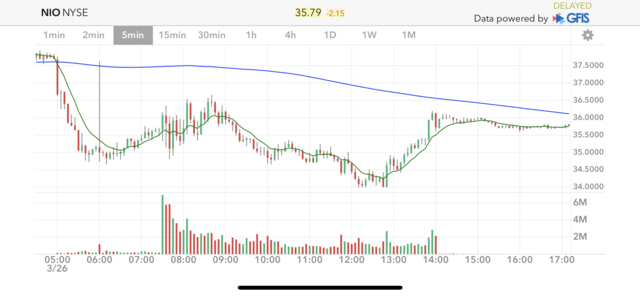

Checkout this 5-minute chart (just for convenience, to show yesterday’s trading):

It includes outside market hours, as can be clearly seen. First thing we can see here is the low volume dump (the price dropped by about $2.50). At 6AM, when the next batch becomes able to trade, there is a desperate attempt to bring the price back up, they kind of close the gap, but come short and it ends up being another sell off. Then, at market open, the real volume comes in and all they can do is move the price up by about $0.7-0.8 within the next hour, which is followed by a decreased volume and a drop to the low of $34. Nothing exciting after that, in my opinion: the price bounces back quite a bit on low volume and the day ends with another little sale. The price stops short below the 200 MA.

Also, I never really look at the Tesla chart because I do not have much interest in it, but I did take a quick look yesterday. The obvious thing here, again, is volume:

There really isn’t that much interest in it compared to a year ago and it really started vanishing last September when the share price was in the $400’s range. That, along with other indicators, suggests to me it is going to head to that same range soon/eventually (soon would be my bet).

One other interesting thing I noticed when looking at the NIO chart a couple of days ago. Nothing interesting in regards to NIO in particular, but I thought an interesting illustration of the power of stop orders. This is a minute chart:

It looks like there were a lot of sell orders set to activate in that $40.10-39.70 -ish range, where a fairly strong support/resistance is. It dropped the price by about $0.50 in a matter of seconds.