Stock Market Discussion

That didn’t pan out well. Weird I thought I posted earlier that probably down it will go. I guess the post didn’t take (maybe I left too quickly?).

I actually was thinking to short it right before close, but didn’t. Instead bought puts for CAN, which may have been a mistake, lol. We will see (March 19 puts).

I actually was thinking to short it right before close, but didn’t. Instead bought puts for CAN, which may have been a mistake, lol. We will see (March 19 puts).

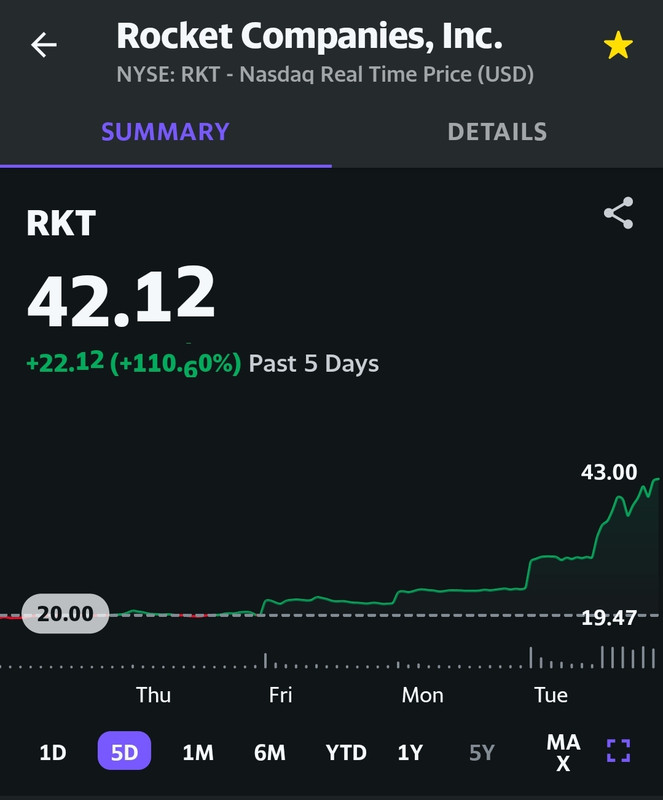

^ I dumped the PLTR bags, put it al into RKT when it was already up almost 20%, also bought some calls. Sold it all at the end of the day and bought next week’s puts.

Also sold the CCIV Friday puts at break even (well, lost a buck and change in total, lol). Should have waited a few more minutes and I would make 50% on those, alas... They were down about 30 or 40% since I bought them.

RCL is moving up. Depending on what happens over next few days, I may be shorting it again. I will also be looking at AMD calls, depending on the movement.

If anyone here is holding AMC, planning a trip to the moon, here is a pretty great read.

Bloomberg: If Only Saving AMC Were as Easy as Buying Stock

Also sold the CCIV Friday puts at break even (well, lost a buck and change in total, lol). Should have waited a few more minutes and I would make 50% on those, alas... They were down about 30 or 40% since I bought them.

RCL is moving up. Depending on what happens over next few days, I may be shorting it again. I will also be looking at AMD calls, depending on the movement.

If anyone here is holding AMC, planning a trip to the moon, here is a pretty great read.

Bloomberg: If Only Saving AMC Were as Easy as Buying Stock

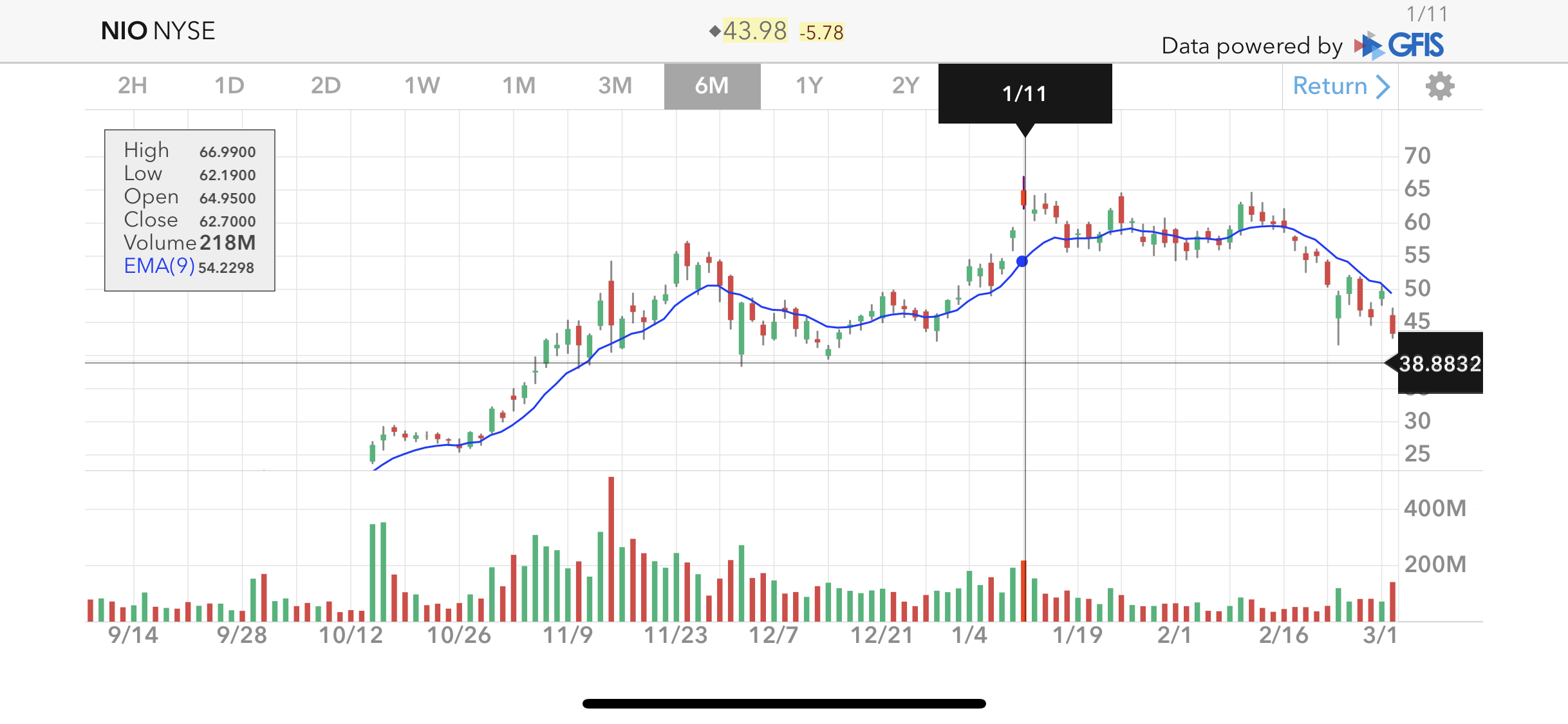

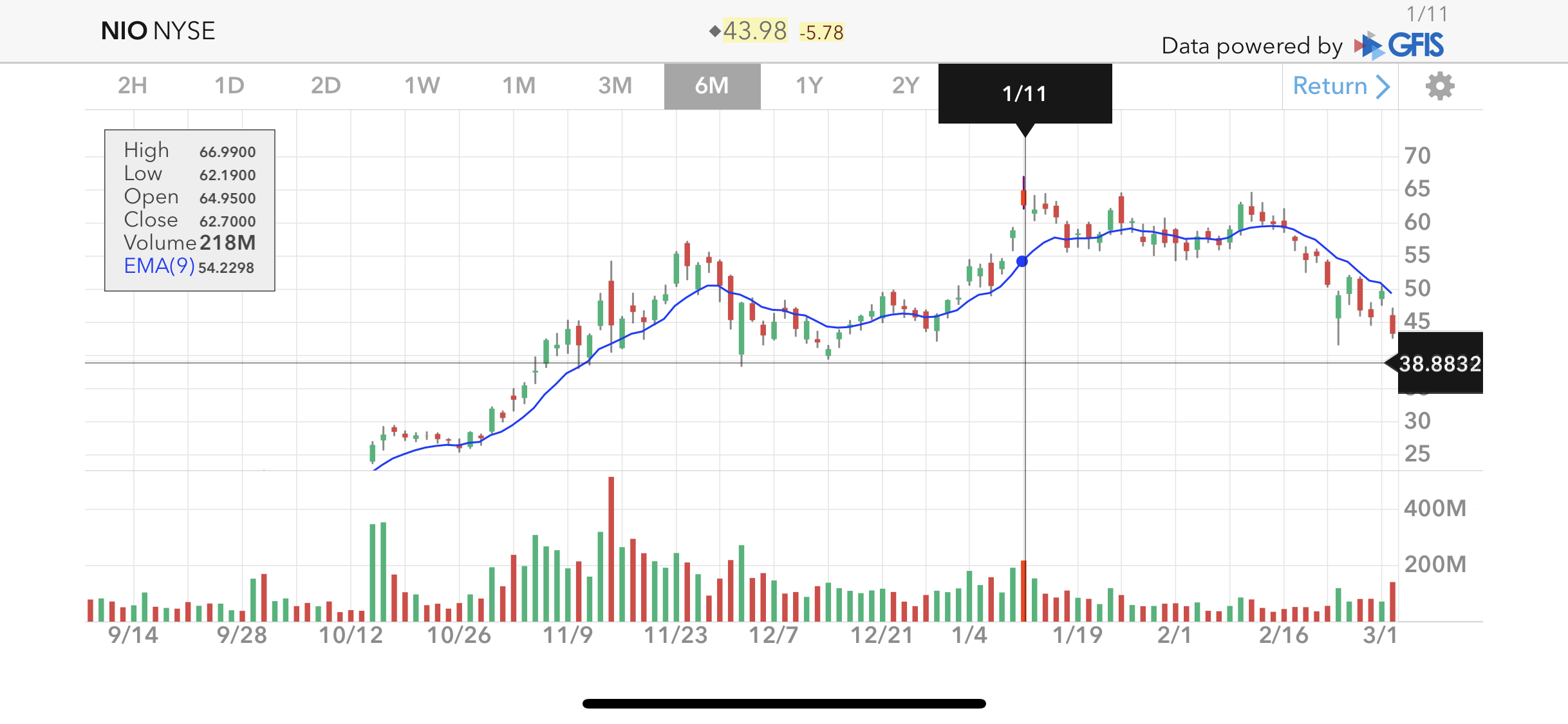

^ Yeah, man. In the long run, you are going to be fine, I am sure. In the short run, on the other hand, I think there is more weakness and still ways to drop. Not sure what I would do and don’t take it as an advice (I mean it, lol), but I would be averaging down (if at all) on the next drop because I think it will come down to $39-38-ish. That’s where the next support is that I see (roughly finger positioned, lol, horizontal line because I am on the phone):

Cktbreaker’s fibonacci’s showed something similar. Doesn’t mean that it will happen though. But many look at those points and set their stops and trade accordingly.

Frankly, my outlook is similar to that as far as the whole market is concerned at the moment (which is not really supported by graphs, etc).

Cktbreaker’s fibonacci’s showed something similar. Doesn’t mean that it will happen though. But many look at those points and set their stops and trade accordingly.

Looks bearish. And then if Tesla breaks that $660-something-whatever-it-is support, it may keep rolling to the low 600-s and in all likelihood take NIO with it. Who knows. Hopefully, I am wrong. It’ll be fine in the long run regardless.cktbreaker wrote: ↑Fri Feb 26, 2021 1:53 pm

1hr NIO chart

I wanted NIO to gain the 52.08 like we were talking about the other day, but it decided not to gain so down it went. If it doesn't hold at something above 45.63 I think it goes to the 2.618.

Frankly, my outlook is similar to that as far as the whole market is concerned at the moment (which is not really supported by graphs, etc).

I thought I would throw this out there. Perhaps, someone is interested.

This book is a pretty great read to learn about the technical side of trading (or some of it, anyway):

Charting and Technical Analysis by Fred McAllen

One can get a pdf version of it here (buy the book if you like it).

There are other great books, but I can’t think of the names off the top of my head.

If anyone has other resources to share, that would be good too.

This book is a pretty great read to learn about the technical side of trading (or some of it, anyway):

Charting and Technical Analysis by Fred McAllen

One can get a pdf version of it here (buy the book if you like it).

There are other great books, but I can’t think of the names off the top of my head.

If anyone has other resources to share, that would be good too.

Fomo’ed and sold the RKT puts way too early, when it got stuck in $33-34s and started climbing up for a few minutes. Missed out on shitload of gains. Like really a lot, lol. Feel like a donkey, but betting against the diamond hands has really thrown me off lately.

^ Looks like your wish came true, lol.

Lots of things are on sale today, but will there be clearance?

The only greens in my basket today are put options, lol: AMC (still a loss though, not sure if will recover), NCLH (up bigly), CAN (still a loss, but will recover, likely today) and a few others.

Lots of things are on sale today, but will there be clearance?

The only greens in my basket today are put options, lol: AMC (still a loss though, not sure if will recover), NCLH (up bigly), CAN (still a loss, but will recover, likely today) and a few others.

These two were really bad moves. I sold CCIV at break even (lost 17 cents on the whole trade, actually). If I held and sold it yesterday as planned , I would make a profit of $530 per put; I had 5.bubbie wrote: ↑Wed Mar 03, 2021 3:07 pmFomo’ed and sold the RKT puts way too early, when it got stuck in $33-34s and started climbing up for a few minutes. Missed out on shitload of gains. Like really a lot, lol. Feel like a donkey, but betting against the diamond hands has really thrown me off lately.

I sold RKT because also an idiot making a gain of $39 per. If sold today, I would collect a profit of ~$390 per. I had 10. The plan was to sell when the stock dipped below $26.

Sad.

Didn’t expect a quick recovery today, so my limits were too high to sell anything. Work got in the way.

I wonder if diamond hands will let me profit on AMC tomorrow. Need to dip just a little more to account for premium. If not, I am getting more puts for next week, or likely the week after. I have $9 puts expiring tomorrow.

Edit: I also think tomorrow will be very red and hope that a stop will work as planned on one of my positions in particular. BTC appears to roll too for now.

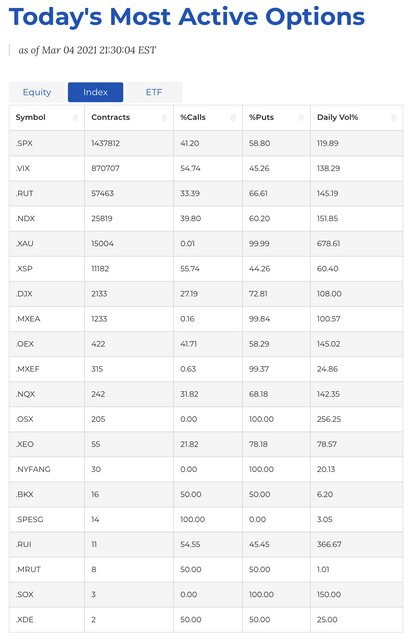

Edit 2: Notice how shorts are more active for pretty much everything:

-

cktbreaker

- Art Expert

- Posts: 1618

- Joined: Sat Jun 13, 2009 10:44 pm

Early week got stopped out of GOEV, BB, FSR, SIRI, GILD, HYLN, CARG, U. Today bought GOEV, BB, ATNF, RKT, NAKD, HYLN, CARG (what the hell does NAKD sell anyway, lulz). Will be taking profits early on these trades. Already moved Stops to break even, not risking anything here. Still have a little NQ and ES short left.

-

cktbreaker

- Art Expert

- Posts: 1618

- Joined: Sat Jun 13, 2009 10:44 pm

Would be good if NQ could close the weekly candle above orange line.

Lol.

The day was quite the opposite if what I expected, lol. Worked out pretty great for me though for the most part.

The random “move” of the day: yesterday I was so convinced that today would be as red as they come that I bought 20 NCLH Mar 5 puts with a strike of $28.5. The total cost to me was $200 (plus a buck or two in commissions). Well, the share offering (15% of outstanding, lol) announcement in the morning could not have come at a better time. I ended up selling them at $110 a piece, lol.

Sold all the other puts I was holding that did not take yesterday. Missed the mark on the $34 NCLH puts by quite a bit but I didn’t have time to monitor. Could have made $3K+ more if I didn’t have to work and would actually be better off, lol.

Only bought VFF, VFF calls, TRLY calls, RCL calls, AMD calls (not entirely comfortable with the AMD, so we will see).

I wish I had more time today. Shitload of stuff was at clearance prices, IMO.

Also, saw EYES was going nutty very early in the AM, but passed on checking if there was anything behind the move. Boy, was I wrong.